Exploring the key elements that impact your life insurance quote, this article delves into the various factors that play a crucial role in determining the cost of your coverage. From age and health to lifestyle choices and occupation, each aspect contributes to the final premium amount.

Let’s unravel the mysteries behind life insurance quotes and understand what influences them the most.

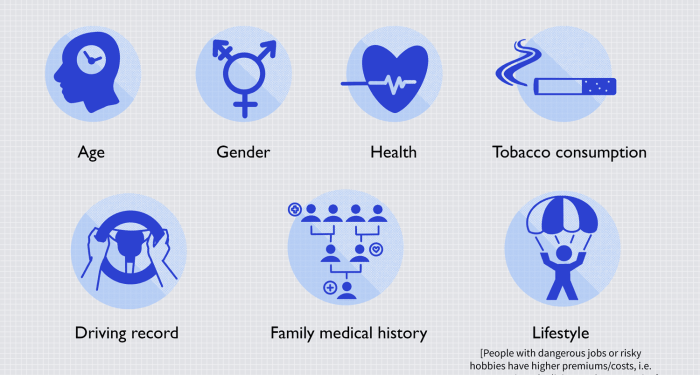

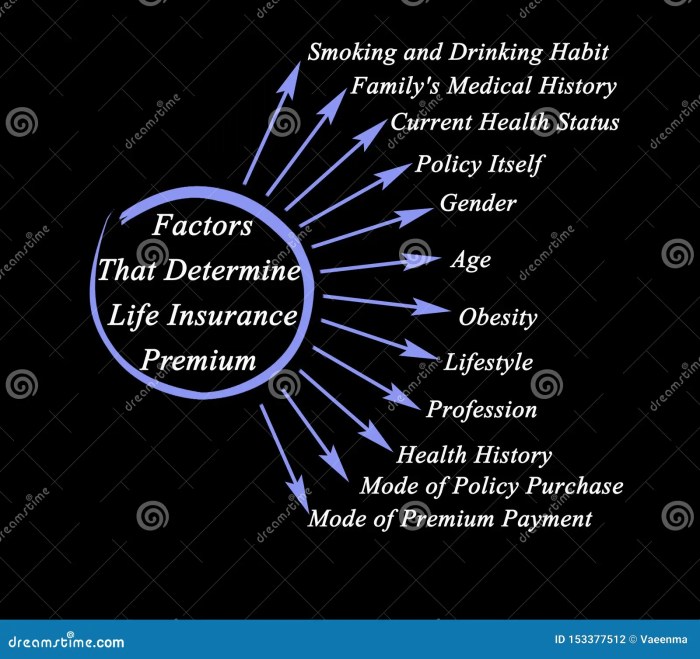

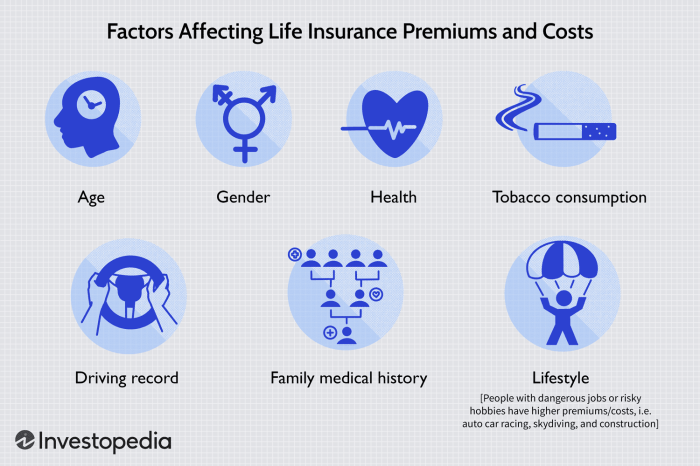

Factors influencing life insurance quotes

Age plays a significant role in determining life insurance quotes. Younger individuals typically receive lower premiums since they are considered less risky to insure. As individuals age, the likelihood of health issues increases, leading to higher premiums to offset the insurance company’s risk.

Health

Health is a crucial factor in determining life insurance premiums. Individuals with pre-existing conditions or unhealthy habits may face higher rates due to the increased risk of premature death. Insurance companies often require medical exams to assess an applicant’s health status accurately.

- Individuals with a history of chronic illnesses such as diabetes or heart disease may face higher premiums.

- Smokers are often charged higher rates due to the increased risk of developing health issues.

- Maintaining a healthy lifestyle through regular exercise and a balanced diet can help lower life insurance costs.

Lifestyle choices

Lifestyle choices also impact life insurance rates. Risky behaviors such as extreme sports or frequent travel to dangerous destinations can lead to higher premiums. Insurance companies assess these factors to determine the level of risk associated with insuring an individual.

- Engaging in high-risk activities like skydiving or rock climbing can result in higher life insurance premiums.

- Individuals with a history of substance abuse may face increased rates due to the associated health risks.

- Demonstrating safe and responsible behavior can help lower life insurance costs.

Occupation

One’s occupation can influence life insurance costs as well. Certain professions may involve higher levels of risk, such as working in law enforcement or firefighting. Insurance companies take into account the occupational hazards associated with a job when determining premiums.

- Individuals working in hazardous occupations may face higher life insurance rates.

- Desk jobs or low-risk professions typically result in lower premiums due to the reduced likelihood of workplace accidents.

- Providing accurate information about one’s occupation is crucial for obtaining an appropriate life insurance quote.

Underwriting factors

When it comes to determining life insurance quotes, underwriting factors play a crucial role in assessing risk and setting premiums. These factors can include medical history, hobbies, family medical history, smoking, and alcohol consumption.

Medical history impact on life insurance quotes

Medical history is a key underwriting factor that can significantly impact life insurance quotes. Insurers consider pre-existing conditions, surgeries, hospitalizations, and medication use when assessing an individual’s health status. A history of serious illnesses or chronic conditions may lead to higher premiums due to increased risk.

- Individuals with a clean bill of health and no significant medical issues typically qualify for lower life insurance rates.

- Those with a history of heart disease, cancer, diabetes, or other serious conditions may face higher premiums or even denial of coverage.

Hobbies and activities affecting life insurance premiums

Engaging in risky hobbies or activities can impact life insurance premiums as insurers assess the likelihood of injury or death. Examples include skydiving, rock climbing, scuba diving, and racing.

- Individuals participating in high-risk hobbies may face higher premiums to compensate for the increased chance of accidents or fatalities.

- Those with safer hobbies like gardening or swimming typically receive lower life insurance rates.

Significance of family medical history in life insurance underwriting

Family medical history is another important underwriting factor as genetic predispositions can influence an individual’s health risks. Insurers consider conditions such as heart disease, cancer, stroke, and diabetes that run in the family.

- If close family members have a history of hereditary diseases, it may impact life insurance quotes as it raises concerns about potential health issues in the insured individual.

- Individuals with a family history of longevity and good health may qualify for better rates as they are perceived as lower risk.

Smoking and alcohol consumption influence on life insurance rates

Smoking and alcohol consumption are lifestyle habits that can greatly affect life insurance rates. Insurers view these habits as risk factors that can lead to various health problems.

- Smokers typically pay significantly higher premiums compared to non-smokers due to the increased risk of developing smoking-related illnesses like lung cancer and heart disease.

- Heavy drinkers or individuals with alcohol abuse issues may also face higher life insurance rates as alcohol consumption can contribute to liver disease, heart problems, and other health issues.

Policy-related factors

When it comes to life insurance quotes, the type and coverage amount of the policy play a significant role in determining the premium cost. Different types of policies offer varying levels of coverage, which directly impacts the price you pay for your life insurance.

Impact of policy type and coverage amount

The type of policy you choose, whether it’s term life insurance or whole life insurance, will affect the quotes you receive. Term life insurance typically offers coverage for a specific period, while whole life insurance provides coverage for your entire life.

The coverage amount you select also influences the premium cost, with higher coverage amounts resulting in higher premiums.

Effect of term length on premium cost

The term length of your policy also plays a role in determining the premium cost. Typically, longer terms result in higher premiums, as the insurance company is taking on a greater risk by providing coverage for a longer period. Shorter terms may offer lower premiums but could leave you without coverage if the policy expires before you pass away.

Choice between term life and whole life insurance

Deciding between term life and whole life insurance can have a significant impact on the quotes you receive. Term life insurance tends to be more affordable initially but may require renewal at higher rates as you age. Whole life insurance, on the other hand, offers lifelong coverage but comes with higher premiums.

Influence of additional riders or add-ons

Adding riders or additional features to your life insurance policy can also affect the cost of your premiums. Riders such as accidental death benefit, waiver of premium, or critical illness coverage can increase the overall cost of your policy. However, these add-ons provide extra protection and benefits that may be worth the additional expense.

External factors influencing life insurance quotes

Economic conditions, regional factors, inflation rates, and market trends are external factors that can significantly impact life insurance premiums. These factors play a crucial role in determining the cost of life insurance policies and can vary based on various external influences.

Economic conditions impact on life insurance premiums

Economic conditions such as GDP growth, unemployment rates, and overall financial stability can affect life insurance premiums. In times of economic uncertainty or recession, insurance companies may increase premiums to mitigate potential risks and uncertainties.

Regional factors affecting life insurance quotes

Regional factors such as population density, crime rates, and natural disaster risks can influence life insurance quotes. Higher crime rates or increased likelihood of natural disasters in a specific region may lead to higher insurance premiums to cover the associated risks.

Inflation and interest rates influence on life insurance costs

Inflation and interest rates can impact the cost of life insurance by affecting the returns on investments made by insurance companies. Higher inflation rates may lead to increased premiums to maintain the purchasing power of the policy benefits over time.

Market trends affecting life insurance policy pricing

Market trends, such as changes in life expectancy, medical advancements, and regulatory developments, can impact life insurance policy pricing. For example, an increase in life expectancy may lead to lower premiums as the risk of premature death decreases.

Last Word

In conclusion, the cost of your life insurance quote is influenced by a multitude of factors, all of which come together to create a personalized premium that reflects your unique circumstances. By understanding the various elements at play, you can make informed decisions when it comes to choosing the right policy for your needs.

Remember, knowledge is key when it comes to securing your financial future through life insurance.

FAQ

How does smoking affect life insurance rates?

Smoking is considered a high-risk behavior by insurance companies, leading to higher premiums for smokers compared to non-smokers.

What role does family medical history play in life insurance underwriting?

Family medical history can impact your life insurance rates, as certain genetic conditions or illnesses may increase the risk of future health issues.

How do market trends influence life insurance policy pricing?

Market trends can affect policy pricing by impacting the overall cost of insurance products based on economic conditions and industry changes.