As What Does a Homeowners Insurance Quote Include and Exclude? takes center stage, this opening passage beckons readers with casual formal language style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

The content of the second paragraph that provides descriptive and clear information about the topic

What is a Homeowners Insurance Quote?

A homeowners insurance quote is an estimate provided by an insurance company detailing the cost of an insurance policy tailored to protect a homeowner’s property and belongings. It serves as a preliminary offer that Artikels the coverage options and associated premiums.

Purpose of a Homeowners Insurance Quote

A homeowners insurance quote is designed to help homeowners understand the potential costs and coverage options available to protect their investment in the event of unforeseen circumstances such as theft, natural disasters, or accidents. By obtaining multiple quotes, homeowners can compare prices and coverage to make an informed decision.

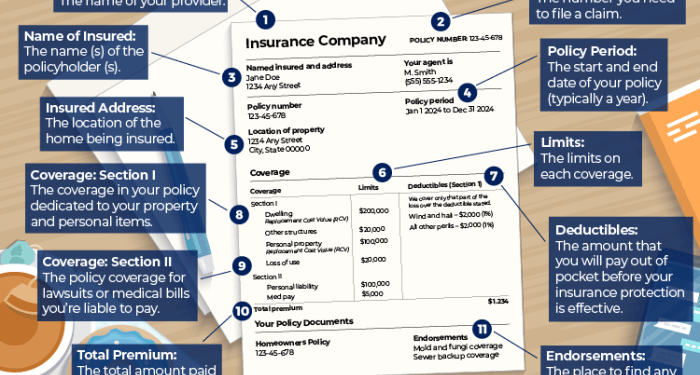

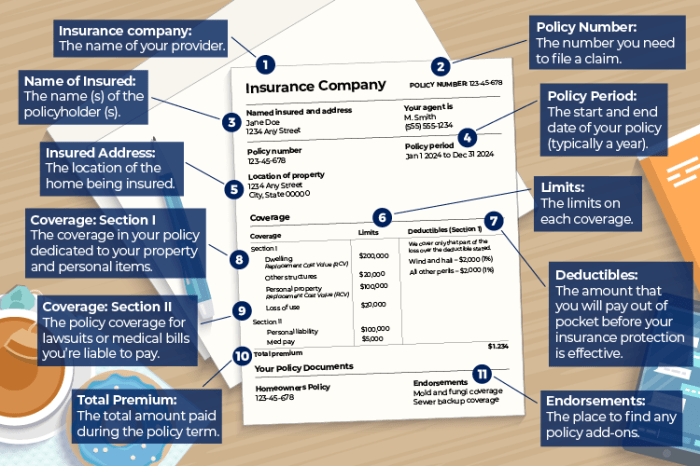

Key Components in a Homeowners Insurance Quote

- Property Coverage: This includes coverage for the physical structure of the home, as well as other structures on the property such as a garage or shed.

- Personal Property Coverage: Protection for personal belongings inside the home, such as furniture, clothing, and electronics.

- Liability Coverage: Coverage for legal expenses and medical bills if someone is injured on the property.

- Additional Living Expenses: Reimbursement for temporary housing and living expenses if the home becomes uninhabitable due to a covered loss.

- Deductible: The amount the homeowner must pay out of pocket before the insurance coverage kicks in.

What Does a Homeowners Insurance Quote Include?

When you request a homeowners insurance quote, it typically includes a variety of coverage types to protect your property and assets in case of unexpected events. Understanding what is included in a homeowners insurance quote can help you choose the right policy for your needs.

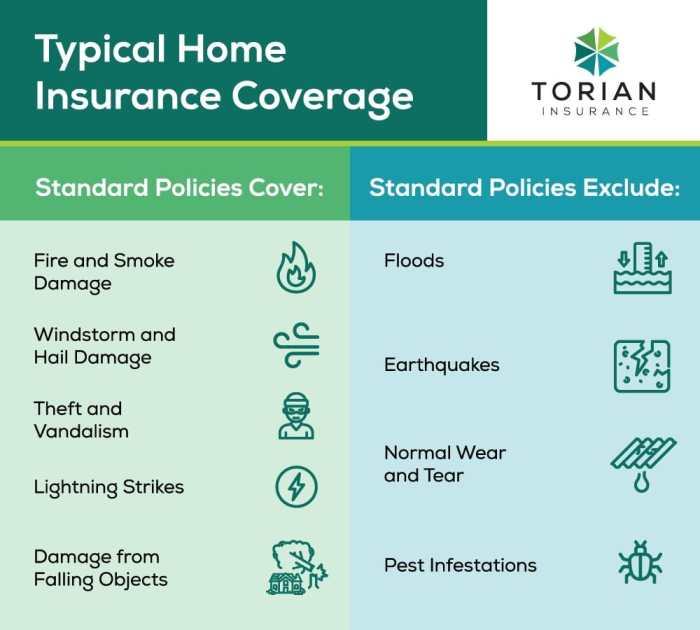

Coverage Types Included in a Standard Homeowners Insurance Quote

- Dwelling coverage: This protects the physical structure of your home, including walls, roof, and foundation, against covered perils like fire, windstorm, and vandalism.

- Personal property coverage: This covers your belongings inside the home, such as furniture, appliances, and clothing, in case of theft, fire, or other covered events.

- Liability coverage: This provides protection if someone is injured on your property and you are found liable for their medical expenses or legal fees.

- Additional living expenses: If your home becomes uninhabitable due to a covered peril, this coverage helps pay for temporary living expenses like hotel stays and meals.

Coverage Limits and Amounts Provided in a Homeowners Insurance Quote

- The coverage limits in a homeowners insurance quote determine the maximum amount the insurer will pay for a covered loss. It’s important to review these limits to ensure they align with the value of your home and possessions.

- Policyholders can choose the amounts of coverage for each type based on their individual needs and budget. Higher coverage limits typically result in higher premiums.

Factors that Influence the Cost of a Homeowners Insurance Quote

- Location: The area where your home is located can impact the cost of insurance due to factors like crime rates, weather risks, and proximity to emergency services.

- Home characteristics: The age, size, construction materials, and condition of your home can influence the cost of insurance. Newer homes with updated features may be cheaper to insure.

- Claims history: If you have a history of filing insurance claims, especially for high-cost incidents, insurers may consider you a higher risk and charge higher premiums.

- Deductible amount: The deductible is the amount you pay out of pocket before your insurance kicks in. A higher deductible typically leads to lower premiums, but you’ll pay more if you file a claim.

What Does a Homeowners Insurance Quote Exclude?

When obtaining a homeowners insurance quote, it is essential to understand what is not covered under a standard policy. Here are common exclusions to be aware of:

1. Flood Damage

One of the most significant exclusions in a homeowners insurance quote is coverage for flood damage. Typically, homeowners would need to purchase a separate flood insurance policy to protect their property from flood-related losses.

2. Earthquake Damage

Similarly, earthquake damage is often excluded from standard homeowners insurance policies. Homeowners residing in earthquake-prone areas may need to purchase additional coverage to safeguard their property against earthquake damage.

3. Wear and Tear

Normal wear and tear of the home, including maintenance issues like plumbing leaks or roof deterioration, are usually not covered by homeowners insurance. It is the homeowner’s responsibility to maintain their property to prevent such damages.

4. Business Activities

If you run a business from your home, any damages or liabilities related to your business activities are typically not covered under a standard homeowners insurance policy. Business owners may need to consider purchasing separate business insurance.

5. Intentional Damage

Intentional damage caused by the homeowner or anyone residing in the property is not covered by homeowners insurance. Any deliberate acts of destruction or harm would not be eligible for a claim.

Final Review

The content of the concluding paragraph that provides a summary and last thoughts in an engaging manner

Commonly Asked Questions

What does a homeowners insurance quote typically include??

A homeowners insurance quote usually includes coverage for your dwelling, personal property, liability protection, and additional living expenses.

What are common exclusions in a homeowners insurance quote?

Common exclusions in a homeowners insurance quote may include flood damage, earthquake damage, and routine maintenance costs.

What factors can influence the cost of a homeowners insurance quote?

Factors such as the location of your home, its age, the coverage limits you choose, and your deductible amount can impact the cost of your homeowners insurance quote.

Can you give examples of situations where coverage may be excluded from a homeowners insurance quote?

Coverage may be excluded for home businesses, high-risk dog breeds, or certain types of high-value items unless you purchase additional coverage.