Delving into Term vs Whole Life Insurance Quotes: Which Is Better for You?, this introduction immerses readers in a unique and compelling narrative, with casual formal language style that is both engaging and thought-provoking from the very first sentence.

The content of the second paragraph that provides descriptive and clear information about the topic

Term Life Insurance

Term life insurance is a type of life insurance that provides coverage for a specified period, typically ranging from 10 to 30 years. If the policyholder passes away during the term, a death benefit is paid out to the beneficiaries.

This type of insurance is known for its simplicity and affordability compared to whole life insurance.

Features and Benefits of Term Life Insurance

- Low Premiums: Term life insurance generally has lower premiums compared to whole life insurance, making it an affordable option for many individuals.

- Flexibility: Policyholders can choose the term length based on their needs, whether it’s to cover a mortgage, children’s education, or income replacement.

- Death Benefit: If the policyholder passes away during the term, a tax-free death benefit is paid out to the beneficiaries, providing financial security.

- Renewability and Convertibility: Some term life insurance policies offer the option to renew or convert to a whole life policy without the need for a medical exam.

Comparison of Term Life Insurance Quotes

When comparing term life insurance quotes from different providers, it’s essential to consider the coverage amount, term length, and premium rates. Factors such as the insurer’s financial strength, customer service reputation, and policy features should also be taken into account.

By obtaining quotes from multiple insurance companies, individuals can find the best coverage at a competitive price.

When Term Life Insurance May Be Suitable

- Young Families: Term life insurance is often recommended for young families who want to ensure financial protection for their loved ones in case of an unexpected death.

- Mortgage Protection: Homeowners can use term life insurance to cover their mortgage balance, ensuring that their family can continue to make mortgage payments in the event of their passing.

- Income Replacement: Individuals who want to replace lost income for a specific period, such as until retirement or until children are financially independent, may opt for term life insurance.

Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. It offers a death benefit to beneficiaries upon the death of the policyholder, along with a cash value component that grows over time.

This cash value can be used for various purposes, such as borrowing against the policy or supplementing retirement income.

Features and Benefits of Whole Life Insurance

Whole life insurance offers several key features and benefits:

- Guaranteed death benefit: The policy provides a guaranteed payout to beneficiaries upon the death of the insured.

- Cash value growth: The cash value component of the policy grows over time on a tax-deferred basis.

- Lifetime coverage: Unlike term life insurance, whole life insurance covers the insured individual for their entire lifetime.

- Fixed premiums: Premiums remain level throughout the life of the policy, providing predictability and stability.

- Dividends: Some whole life policies may pay out dividends, which can be used to increase the cash value or reduce premiums.

Comparison of Whole Life Insurance Quotes

When comparing whole life insurance quotes from different providers, it’s essential to consider factors such as the coverage amount, premium cost, cash value growth potential, and any additional riders or benefits offered. Quotes can vary based on the age, health, and lifestyle of the insured individual, so it’s crucial to obtain multiple quotes to find the best option.

When Whole Life Insurance May Be Suitable

Whole life insurance may be a suitable option for individuals who are looking for lifelong coverage, guaranteed death benefits, and a cash value component that can grow over time. It can also be a valuable tool for estate planning, providing a tax-advantaged way to transfer wealth to beneficiaries.

Factors to Consider

When deciding between term and whole life insurance, there are several important factors to take into consideration. These factors can greatly impact the type of coverage that will best suit your needs and financial goals.

Age and Health

Age and health play a significant role in determining insurance quotes for both term and whole life insurance. Younger and healthier individuals typically receive lower premiums for both types of policies. However, older individuals or those with existing health conditions may find whole life insurance more cost-effective in the long run due to guaranteed coverage for life.

Coverage Amounts

The amount of coverage you require is another crucial factor to consider when choosing between term and whole life insurance. Term life insurance is usually more affordable for higher coverage amounts since it provides coverage for a specific term, while whole life insurance offers lifelong coverage but at a higher premium cost.

Financial Implications

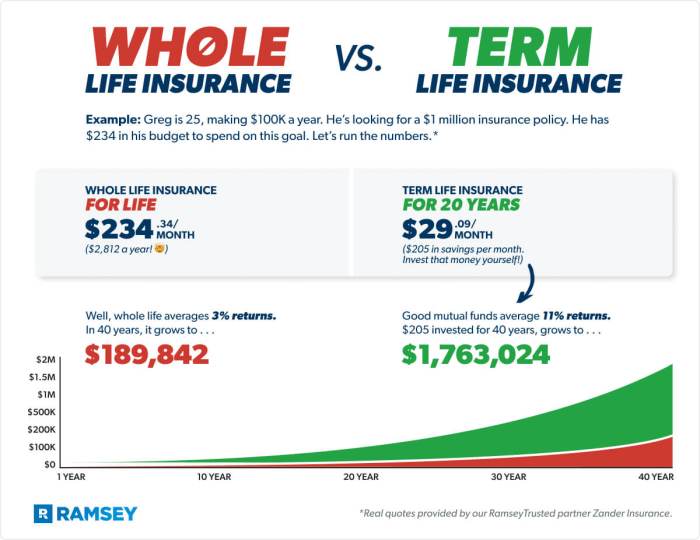

The financial implications of term vs whole life insurance can also influence your decision. Term life insurance is generally more affordable upfront, making it a popular choice for those on a budget or needing coverage for a specific period. On the other hand, whole life insurance builds cash value over time and can serve as an investment vehicle, making it a suitable option for long-term financial planning.

Customizing Insurance Quotes

When it comes to insurance, one size does not fit all. Customizing insurance quotes to suit individual needs is crucial in ensuring adequate coverage and financial protection. By tailoring your policy, you can adjust coverage, premiums, and add-ons to meet your specific requirements.

Tips for Customizing Insurance Quotes

- Assess your needs: Determine the amount of coverage you require based on your financial obligations, dependents, and future goals.

- Consider riders and add-ons: Explore additional options such as critical illness riders, accidental death benefits, or disability coverage to enhance your policy.

- Adjust coverage and premiums: Work with your insurance provider to find a balance between coverage and affordability that meets your budget and protection needs.

- Review regularly: Periodically review your policy to ensure it still aligns with your current circumstances and make adjustments as necessary.

Impact of Customization on Insurance Cost and Benefits

Customizing your insurance policy can have a significant impact on both the cost and benefits you receive. For example, adding a critical illness rider may increase your premiums, but provide added financial protection in case of a serious illness. On the other hand, adjusting your coverage levels downward may lower your premiums but leave you exposed to greater risk.

Ultimate Conclusion

The content of the concluding paragraph that provides a summary and last thoughts in an engaging manner

Detailed FAQs

What are the main differences between term life insurance and whole life insurance?

Term life insurance provides coverage for a specific term, while whole life insurance covers you for your entire life. Term life insurance is usually more affordable, while whole life insurance offers lifelong coverage and a cash value component.

How do age and health affect insurance quotes for term vs whole life insurance?

Age and health play a significant role in determining insurance quotes. Younger and healthier individuals generally get lower quotes for both term and whole life insurance compared to older or less healthy individuals.

Can you customize insurance quotes to suit individual needs?

Yes, insurance policies can be customized based on individual needs. You can adjust coverage amounts, choose riders and add-ons, and tailor premiums to fit specific requirements.