Delve into the world of small business insurance coverage, demystified for easy understanding. As we unravel the complexities, prepare to be enlightened by the significance and benefits of securing your business with the right insurance protection.

Moving forward, we will explore the various types of coverage, factors to consider when choosing insurance, and practical tips to manage costs effectively. Stay tuned for a comprehensive guide tailored to small business owners seeking clarity in the realm of insurance coverage.

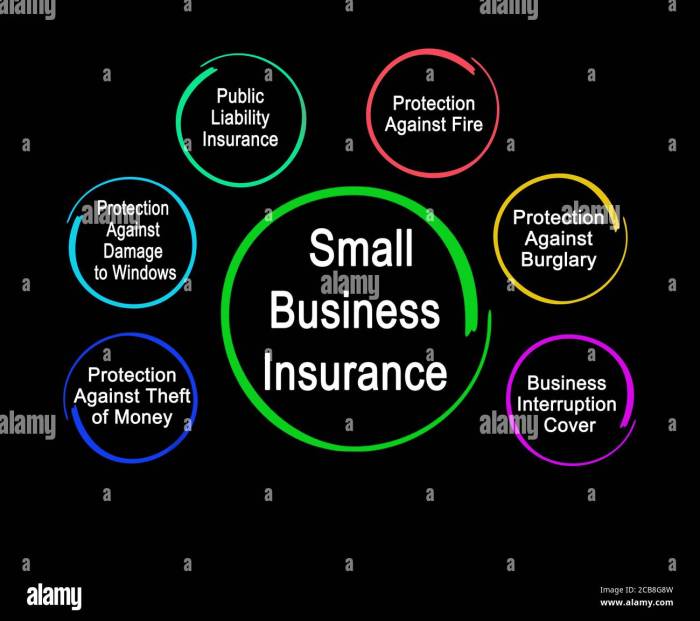

Overview of Small Business Insurance

Small business insurance plays a crucial role in protecting businesses from unforeseen risks and liabilities. It provides coverage for various aspects of a business, ensuring financial security and peace of mind for business owners.

Types of Coverage Included

- General Liability Insurance: Protects against third-party claims for bodily injury, property damage, and advertising injury.

- Property Insurance: Covers damage or loss of business property due to fire, theft, or other covered events.

- Business Interruption Insurance: Reimburses lost income and expenses when a business is unable to operate due to a covered event.

- Workers’ Compensation Insurance: Provides benefits to employees who are injured or become ill while on the job.

- Professional Liability Insurance: Also known as Errors and Omissions insurance, it protects against claims of professional negligence or mistakes.

Importance of Having Insurance Coverage

Having insurance coverage for a small business is essential as it helps mitigate financial risks and liabilities that could otherwise lead to significant losses or even bankruptcy. It provides a safety net for unexpected events that could disrupt operations or result in legal claims.

Benefits of Small Business Insurance

- Protection against lawsuits: Small business insurance can cover legal fees and damages in the event of a lawsuit.

- Peace of mind: Knowing that the business is protected can give business owners peace of mind and allow them to focus on growth and success.

- Compliance with requirements: Some types of insurance, such as workers’ compensation, are mandatory by law in many states.

- Recovery after a disaster: Insurance coverage can help businesses recover and resume operations after a disaster or unforeseen event.

Types of Small Business Insurance Coverage

When it comes to protecting your small business, having the right insurance coverage is crucial. Here are the different types of insurance coverage available for small businesses:

General Liability Insurance

General liability insurance is essential for small businesses as it provides coverage for third-party bodily injuries, property damage, and advertising injury claims. This type of insurance protects your business from lawsuits and helps cover legal fees and settlement costs.

Property Insurance

Property insurance is important for small businesses that own or lease a physical space. It helps protect your building, equipment, inventory, and other assets from damage or loss due to fire, theft, vandalism, or other covered perils.

Workers’ Compensation Insurance

Workers’ compensation insurance is mandatory in most states for businesses with employees. This type of insurance provides coverage for medical expenses, lost wages, and disability benefits for employees who are injured or become ill on the job. It helps protect your business from lawsuits related to workplace injuries.

Factors to Consider When Choosing Small Business Insurance

When selecting insurance coverage for a small business, there are several key factors that business owners should take into consideration. The size and nature of the business play a significant role in determining the type and extent of insurance coverage needed.

Here are some tips on how to assess the insurance needs of a small business:

Business Size and Operations

- Consider the size of your business, including the number of employees and annual revenue, as this can impact the level of coverage needed.

- Assess the nature of your business operations, such as the industry you operate in and the risks associated with your specific line of work.

- Review your business assets, including property, equipment, and inventory, to determine the value that needs to be protected.

Legal Requirements and Industry Regulations

- Research the legal requirements for insurance coverage in your industry and locality to ensure compliance with regulations.

- Understand the specific risks and liabilities that are common in your industry and tailor your insurance coverage to address these concerns.

Risk Assessment and Coverage Options

- Conduct a thorough risk assessment to identify potential threats to your business, such as property damage, liability claims, or business interruption.

- Explore different types of insurance coverage options, including general liability, property insurance, worker’s compensation, and professional liability, to determine the most suitable policies for your business.

- Consider additional coverage options, such as cybersecurity insurance or business interruption insurance, based on your specific needs and vulnerabilities.

Cost of Small Business Insurance

Understanding how the cost of small business insurance is determined is crucial for managing and reducing expenses while ensuring adequate coverage for your business.

Factors Influencing Insurance Costs

- Industry Risk: Some industries are riskier than others, leading to higher premiums.

- Business Size: The size of your business, including revenue and number of employees, can impact insurance costs.

- Location: The geographic location of your business can affect insurance rates due to varying regulations and risks.

- Claims History: A history of frequent or large claims may result in higher premiums.

Ways to Manage and Reduce Insurance Costs

- Shop Around: Compare quotes from multiple insurance providers to find the best rates.

- Bundle Policies: Consider bundling multiple types of insurance with the same provider for potential discounts.

- Implement Risk Management Strategies: Proactively address risks to reduce the likelihood of claims and lower premiums.

- Adjust Coverage Limits: Evaluate your coverage needs regularly and adjust limits to avoid over-insuring.

Cost-Effective Insurance Options

- Business Owner’s Policy (BOP): A BOP combines general liability and property insurance into one affordable package.

- Professional Liability Insurance: Also known as errors and omissions insurance, this coverage protects against claims of negligence or inadequate work.

- Commercial Auto Insurance: If your business uses vehicles for operations, this coverage is essential and can be cost-effective.

- Workers’ Compensation Insurance: Provides coverage for work-related injuries and illnesses, often required by law for businesses with employees.

Conclusion

In conclusion, Small Business Insurance Coverage Explained in Simple Terms equips you with essential knowledge to safeguard your business against unforeseen risks. Harness the power of insurance as a strategic asset in your entrepreneurial journey, ensuring stability and protection every step of the way.

Clarifying Questions

What types of coverage are typically included in small business insurance?

Small business insurance commonly includes general liability, property, and workers’ compensation coverage to protect against various risks and liabilities.

How is the cost of small business insurance determined?

The cost of small business insurance is influenced by factors such as the type of coverage, business size, industry risks, and claims history. Insurers assess these factors to calculate a premium that reflects the level of risk.

Why is insurance coverage important for small businesses?

Insurance coverage provides financial protection and peace of mind for small businesses facing unexpected events like lawsuits, property damage, or employee injuries. It helps businesses mitigate risks and continue operations smoothly.