Embark on a journey to understand the intricacies of comparing life insurance quotes and maximizing your savings. This guide will walk you through the essentials, empowering you to make informed decisions and secure your financial future with confidence.

In the following paragraphs, we will delve into the crucial aspects of life insurance comparison, shedding light on key considerations and money-saving strategies.

Understanding Life Insurance Quotes

When looking to purchase life insurance, it is crucial to understand the components of a life insurance quote, the key factors that influence life insurance premiums, and the importance of comparing quotes from different providers.

Components of a Life Insurance Quote

- The death benefit: This is the amount of money that will be paid out to your beneficiaries upon your passing.

- Premium amount: This is the cost you will pay for the life insurance policy, typically on a monthly or annual basis.

- Policy term: This refers to the length of time the policy will be in effect.

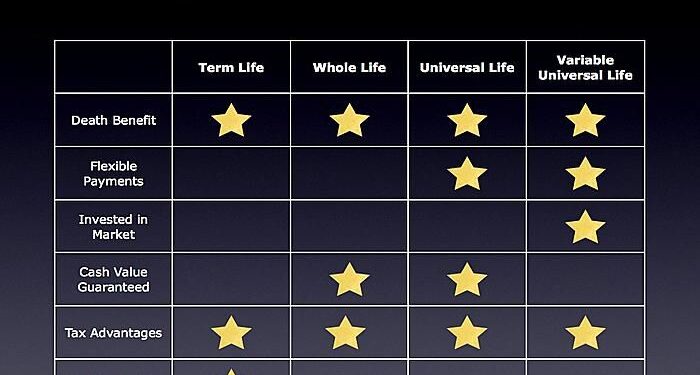

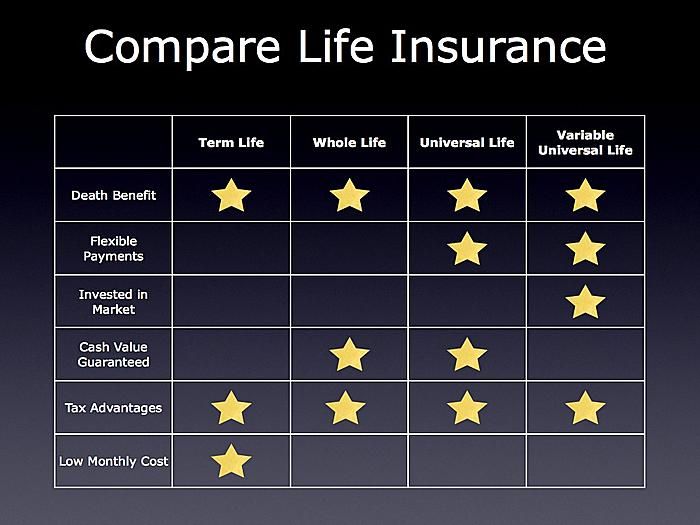

- Policy type: There are various types of life insurance policies, such as term life, whole life, and universal life insurance.

Key Factors Influencing Life Insurance Premiums

- Age: Younger individuals typically pay lower premiums compared to older individuals.

- Health: Your overall health and any pre-existing conditions can impact the cost of your life insurance policy.

- Lifestyle habits: Factors such as smoking, drinking, and participation in risky activities can also influence premiums.

- Coverage amount: The higher the death benefit, the higher the premium will likely be.

Importance of Comparing Quotes

- Cost savings: By comparing quotes from different providers, you can find a policy that offers the coverage you need at a more affordable price.

- Policy customization: Different providers may offer varying policy options and riders, allowing you to tailor your coverage to meet your specific needs.

- Customer service and reputation: Researching and comparing quotes can help you choose a reputable insurance provider with excellent customer service.

How to Compare Life Insurance Quotes

When it comes to comparing life insurance quotes, it’s essential to follow a structured approach to ensure you’re getting the best coverage at the most competitive rates. Here’s a step-by-step guide on how to request and compare quotes effectively:

Requesting and Comparing Quotes

Before diving into the comparison process, it’s important to request quotes from multiple insurance providers. You can do this by visiting insurance company websites, using online comparison tools, or reaching out to insurance agents directly. Once you have gathered a few quotes, follow these steps:

- Compare premiums: Look at the premium amounts offered by each provider for the same coverage amount.

- Evaluate coverage amounts: Make sure you’re comparing quotes for the same coverage amounts and types to get an accurate comparison.

- Check for additional benefits: Some policies may offer additional benefits or riders that could be valuable to you. Consider these when comparing quotes.

- Review the reputation of the insurer: Check the financial stability and customer reviews of the insurance companies to ensure you’re choosing a reliable provider.

Evaluating Coverage Amounts and Types

When comparing life insurance quotes, it’s crucial to evaluate the coverage amounts and types offered by different insurers. Consider the following:

- Term vs. whole life insurance: Understand the difference between term and whole life insurance policies and determine which aligns best with your needs.

- Assess your coverage needs: Calculate the amount of coverage you need based on your financial obligations, such as mortgage payments, children’s education, and other expenses.

- Consider future needs: Factor in any future financial obligations, such as college tuition for children or retirement savings, when deciding on coverage amounts.

Reviewing Policy Terms and Conditions

Before finalizing your decision, take the time to review the policy terms and conditions provided by each insurer. Pay attention to:

- Exclusions: Understand what is not covered by the policy to avoid any surprises in the future.

- Policy riders: Check for any additional riders or benefits that can be added to the policy for extra coverage.

- Policy duration: Clarify the length of the policy term and any renewal options available.

Saving Money on Life Insurance

When it comes to life insurance, there are several ways you can save money while still ensuring you have adequate coverage. By being strategic in your approach, you can make the most of your budget and find a policy that fits your needs without breaking the bank.

Bundling Insurance Policies

One effective way to save money on life insurance is by bundling your policies. This means purchasing multiple insurance policies from the same provider, such as combining your life insurance with auto or home insurance. By doing so, insurance companies often offer discounts or reduced premiums, ultimately saving you money in the long run.

Impact of Lifestyle Choices on Premiums

Another important factor to consider when trying to save money on life insurance is how your lifestyle choices can impact your premiums. For instance, maintaining a healthy lifestyle, such as exercising regularly and eating a balanced diet, can lead to lower premiums as insurers view you as a lower risk.

Conversely, habits like smoking or engaging in risky activities can result in higher premiums due to the increased likelihood of health issues or accidents.

Factors to Consider When Comparing Quotes

When comparing life insurance quotes, there are several key factors to keep in mind that can significantly impact the cost and coverage of your policy.Discussing the different types of life insurance policies available will give you a better understanding of what options are out there and what might be the best fit for your needs.

Term Life Insurance vs. Whole Life Insurance

- Term life insurance is typically more affordable compared to whole life insurance because it provides coverage for a specific term, such as 10, 20, or 30 years, while whole life insurance covers you for your entire life.

- Whole life insurance also includes a cash value component that can grow over time, providing additional benefits, but it comes with higher premiums.

- Consider your budget, long-term financial goals, and coverage needs when deciding between term and whole life insurance.

Impact of Age, Health, and Lifestyle

- Your age plays a significant role in determining life insurance rates, with younger individuals generally paying lower premiums compared to older individuals.

- Your health status, including any pre-existing conditions or lifestyle habits like smoking, can also impact your rates. Maintaining a healthy lifestyle can help lower your premiums.

- Insurance companies may require a medical exam to assess your health and determine your risk level, which can influence the cost of your policy.

Conclusive Thoughts

As we wrap up our discussion on comparing life insurance quotes and saving big, remember that knowledge is your greatest asset in navigating the realm of insurance. By implementing the insights gained from this guide, you can embark on a path towards financial security and peace of mind.

FAQ Corner

What factors should I consider when comparing life insurance quotes?

When comparing life insurance quotes, pay attention to coverage amounts, policy terms, and any additional benefits offered by different providers. It’s also essential to consider your personal needs and future financial goals to make an informed decision.

Is it better to choose term life insurance or whole life insurance for cost savings?

Term life insurance typically offers lower premiums compared to whole life insurance, making it a cost-effective option for many individuals. However, the choice between the two depends on your specific financial situation and long-term objectives.

Can lifestyle choices really impact life insurance premiums?

Yes, lifestyle choices such as smoking, drinking, and engaging in high-risk activities can influence your life insurance premiums. Maintaining a healthy lifestyle and minimizing risky behaviors can help you secure more affordable insurance rates.