Comparing Life Insurance Providers: What Matters Most? sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with a casual formal language style and brimming with originality from the outset.

The topic delves into the crucial aspects of selecting a life insurance provider, shedding light on key considerations that can impact your decision-making process.

Factors to Consider when Comparing Life Insurance Providers

When comparing life insurance providers, there are several key factors to consider to ensure you choose the best policy for your needs. Understanding the different types of life insurance policies available in the market, the importance of coverage amount, and the flexibility and customization options offered by providers are crucial in making an informed decision.

Types of Life Insurance Policies

- Term Life Insurance: Provides coverage for a specific period of time.

- Whole Life Insurance: Offers coverage for the entire lifetime of the insured.

- Universal Life Insurance: Combines a death benefit with a savings component.

Importance of Coverage Amount

It is essential to determine the right coverage amount based on your individual needs, such as replacing income, paying off debts, or covering final expenses. Calculating your financial obligations and future expenses can help you select a policy that adequately meets your requirements.

Policy Flexibility and Customization Options

Look for insurance providers that offer flexibility in adjusting coverage amounts, premium payments, and additional riders to tailor the policy to your specific circumstances. Customization options allow you to adapt your policy as your financial situation or life circumstances change, ensuring your coverage remains relevant and adequate.

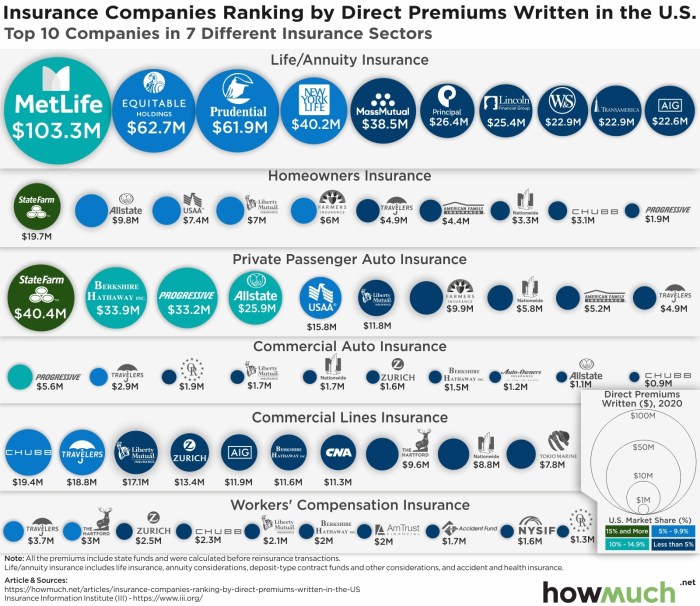

Reputation and Financial Stability of Insurance Companies

When comparing life insurance providers, it is crucial to consider both the reputation and financial stability of the companies. Understanding how to research and assess these aspects can help you make an informed decision when choosing a life insurance provider.

Researching and Assessing Reputation

Reputation plays a significant role in determining the reliability and trustworthiness of an insurance provider. Here are some ways to research and assess the reputation of an insurance company:

- Check online reviews and ratings from customers to get an idea of their experiences with the company.

- Look for any complaints filed against the insurer with regulatory bodies or consumer protection agencies.

- Consider the company’s history and how long they have been in the insurance industry.

Significance of Financial Stability

The financial stability of an insurance company is crucial as it determines their ability to fulfill their financial obligations, such as paying out claims. Here’s why financial stability matters:

- Financially stable insurers are more likely to weather economic downturns and market fluctuations, ensuring the security of policyholders.

- Companies with strong financial ratings are seen as less risky, providing peace of mind to policyholders.

- Financially unstable insurers may struggle to pay out claims, putting policyholders at risk of not receiving the benefits they are entitled to.

Rating Agencies and Tools

There are several rating agencies and tools available to evaluate the financial health of insurers. Some commonly used resources include:

- AM Best:AM Best is a well-known rating agency that specializes in assessing the financial strength of insurance companies.

- Standard & Poor’s:Standard & Poor’s provides credit ratings for insurance companies, indicating their financial stability and ability to meet obligations.

- Moodys:Moody’s Investors Service offers credit ratings and research on insurance companies, helping consumers make informed decisions.

Customer Service and Claims Process

Customer service plays a vital role in the overall experience with an insurance provider. It is crucial for policyholders to have access to helpful and responsive customer service representatives who can address any inquiries or concerns promptly.

Claims Process and Turnaround Time

- When comparing life insurance providers, it is essential to understand the typical claims process and turnaround time for each company. This involves knowing how to file a claim, what documentation is required, and how long it takes for a claim to be processed.

- Some insurance companies have a straightforward online claims process, allowing policyholders to submit claims electronically and track their status online. Others may require claims to be submitted via mail or through an agent.

- The turnaround time for processing claims can vary significantly among insurance providers. Some companies pride themselves on quick claim processing, while others may take longer to review and approve claims.

Online Reviews and Customer Feedback

- One way to gauge customer satisfaction levels with different life insurance providers is to look at online reviews and customer feedback. Websites like Trustpilot, Consumer Affairs, and the Better Business Bureau can provide insights into the experiences of policyholders with a particular insurance company.

- Positive reviews often highlight excellent customer service, smooth claims processes, and timely payouts. On the other hand, negative reviews may point out issues with claim denials, delays, or poor communication from the insurance provider.

- By comparing online reviews and customer feedback, individuals can get a sense of how satisfied current and past policyholders are with their insurance company, helping them make an informed decision when choosing a life insurance provider.

Additional Benefits and Riders Offered by Insurance Companies

When selecting a life insurance policy, it’s crucial to consider not only the basic coverage but also the additional benefits and riders offered by insurance companies. These riders can enhance your policy and provide added protection based on your individual circumstances.

Understanding which riders are essential for your needs is key to making an informed decision. Let’s delve into the common riders and additional benefits offered by insurers and how to determine their importance.

Common Riders and Additional Benefits

- Accidental Death Benefit Rider: Provides an additional payout if the insured dies in an accident.

- Waiver of Premium Rider: Waives premium payments if the policyholder becomes disabled.

- Critical Illness Rider: Offers a lump sum payment upon diagnosis of a critical illness.

- Term Conversion Rider: Allows the conversion of a term policy to a permanent policy without the need for a medical exam.

Determining Essential Riders

- Assess your individual needs and risks to determine which riders are essential for your situation.

- Consider factors such as age, health, occupation, and financial obligations when selecting riders.

- Consult with a financial advisor or insurance agent to get personalized guidance on which riders are most suitable for you.

Comparison of Additional Benefits Offered

| Insurance Company | Additional Benefits | Package Details |

|---|---|---|

| Company A | Child Term Rider, Living Benefits Rider | Option to add riders at an additional cost, flexible packages |

| Company B | Accelerated Death Benefit Rider, Return of Premium Rider | Included in some policies, customization available for others |

Ultimate Conclusion

In conclusion, Comparing Life Insurance Providers: What Matters Most? serves as a comprehensive guide for individuals navigating the complex landscape of life insurance options. By focusing on the critical factors discussed, readers can make informed choices that align with their unique needs and preferences.

FAQ Section

What factors should I consider when comparing life insurance providers?

When comparing life insurance providers, it’s essential to evaluate factors such as the types of policies available, coverage amount, policy flexibility, reputation, financial stability, customer service, claims process, and additional benefits offered.

How can I assess the financial stability of an insurance company?

You can assess the financial stability of an insurance company by reviewing its financial ratings from reputable agencies, analyzing its financial statements, and researching its history of claim payouts.

What are common riders offered by insurance companies?

Common riders offered by insurance companies include critical illness riders, accidental death benefit riders, waiver of premium riders, and term conversion riders.