Starting off with Best Business Insurance Providers for LLCs in 2025, this opening paragraph aims to engage readers with a captivating overview of the topic.

As we delve deeper into the trends, providers, customer reviews, customized plans, legal compliance, and risk management strategies, the discussion unfolds with valuable insights.

Research on Latest Trends

In the ever-evolving landscape of business insurance, it is crucial to stay updated on the latest trends that are shaping the industry for LLCs. These trends not only impact the insurance offerings available but also influence the overall risk management strategies of businesses.

Increased Focus on Cyber Insurance

With the rise of cyber threats and data breaches, there is a growing emphasis on cyber insurance policies for LLCs. These policies provide coverage against various cyber risks, such as data breaches, ransomware attacks, and business interruption due to cyber incidents.

As more businesses rely on digital operations, the demand for robust cyber insurance coverage is expected to continue to rise.

Personalized Insurance Solutions

Technological advancements, such as big data analytics and AI, have enabled insurance providers to offer more personalized insurance solutions tailored to the specific needs of LLCs. By analyzing data on business operations, risk factors, and historical claims, insurers can create customized insurance packages that provide comprehensive coverage while optimizing costs for businesses.

Integration of Insurtech

The integration of Insurtech (insurance technology) solutions is revolutionizing the way insurance products are developed, sold, and managed for LLCs. Insurtech tools, such as digital platforms, automated underwriting processes, and AI-driven risk assessment models, are streamlining insurance operations and enhancing the overall customer experience.

This integration is enabling insurers to offer more efficient and cost-effective insurance solutions to LLCs.

Sustainable and ESG Insurance

There is a growing trend towards sustainable and Environmental, Social, and Governance (ESG) focused insurance products for LLCs. Insurers are increasingly incorporating ESG criteria into their underwriting processes and developing insurance products that promote sustainability and social responsibility. This trend reflects the increasing importance of ESG considerations in business operations and risk management practices.

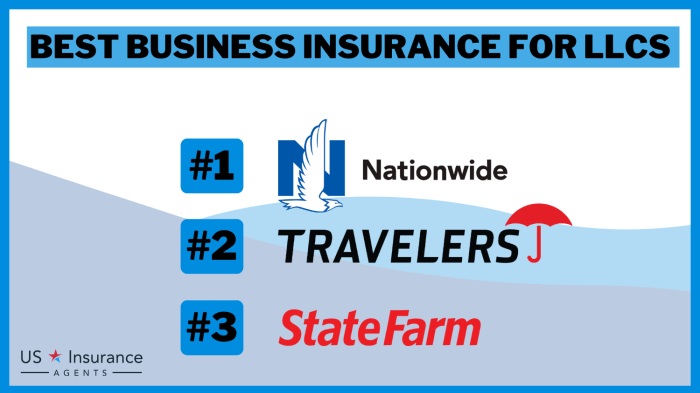

Top Insurance Providers

When it comes to finding the best business insurance for LLCs, it’s essential to consider the top insurance providers in the market. These providers offer a range of services, coverage options, and pricing to cater specifically to the needs of limited liability companies.

Let’s take a closer look at some of the top insurance providers for LLCs and compare their offerings.

1. Hiscox

Hiscox is a well-known insurance provider that offers specialized coverage for LLCs. They provide general liability insurance, professional liability insurance, and business owner’s policies tailored to the unique needs of small businesses. Hiscox is known for its quick online quotes and flexible coverage options, making it a popular choice among LLC owners.

2. The Hartford

The Hartford is another top insurance provider that caters to LLCs. They offer a wide range of insurance products, including general liability insurance, workers’ compensation, and commercial property insurance. The Hartford is known for its excellent customer service and customizable coverage options, making it a reliable choice for LLCs of all sizes.

3. Chubb

Chubb is a leading insurance provider that offers comprehensive coverage options for LLCs. They specialize in property and casualty insurance, professional liability insurance, and cyber risk insurance. Chubb is known for its high coverage limits and personalized risk management solutions, making it a top choice for LLCs looking for extensive protection.

Customer Reviews and Ratings

Customer reviews and ratings play a crucial role in helping LLCs choose the right insurance provider. They provide valuable insights into the customer service, claim processes, and overall satisfaction levels offered by different insurance companies. Analyzing these reviews can help businesses make informed decisions when selecting an insurance provider for their LLC.

Customer Service

Customer reviews often highlight the quality of customer service provided by insurance companies. Positive reviews frequently mention helpful and responsive customer service representatives who assist with any queries or concerns promptly. On the other hand, negative reviews may indicate issues with delayed responses, unhelpful staff, or difficulty in reaching customer service representatives.

Claim Processes

Feedback on claim processes is another essential aspect to consider when evaluating insurance providers. Positive reviews typically mention smooth and efficient claim processes, with quick payouts and minimal hassle. Conversely, negative reviews may point out delays in processing claims, disputes over coverage, or difficulties in getting claims approved.

Overall Satisfaction

The overall satisfaction level of customers with their insurance provider is reflected in their reviews and ratings. Businesses should pay attention to feedback regarding policy pricing, coverage options, and ease of communication with the insurance company. High ratings and positive reviews generally indicate a high level of satisfaction among customers, while low ratings and negative reviews may signal areas of improvement for the insurance provider.

Customized Insurance Plans

When it comes to protecting your LLC, having a customized insurance plan in place is crucial. These tailored solutions can provide coverage specific to the unique risks and needs of your business, offering a more comprehensive and effective protection strategy.

Let’s explore the importance of customized insurance plans for LLCs and examples of how leading providers offer personalized coverage options.

Examples of Tailored Insurance Solutions

- Professional Liability Insurance: Providers like Hiscox and Nationwide offer customized professional liability insurance plans for LLCs in various industries such as consulting, technology, and healthcare. These plans are designed to protect against claims of negligence, errors, or omissions specific to the professional services provided by the LLC.

- Commercial Property Insurance: Companies like The Hartford and Chubb provide personalized commercial property insurance policies that can be tailored to the specific needs of the LLC, whether it operates from a physical location or relies on equipment and inventory for its operations.

- Cyber Liability Insurance: Leading insurers such as Travelers and AIG offer customized cyber liability insurance plans to protect LLCs from data breaches, cyber attacks, and other digital risks. These plans can be adjusted based on the size of the business and the industry it operates in.

Benefits of Personalized Insurance Coverage

- Enhanced Protection: Customized insurance plans ensure that your LLC is adequately covered against the specific risks it faces, providing a more robust level of protection compared to generic policies.

- Cost-Effectiveness: By tailoring the coverage to your business needs, you can avoid paying for unnecessary insurance components, making the policy more cost-effective in the long run.

- Industry-Specific Coverage: Personalized insurance solutions take into account the unique challenges of different industries, offering specialized coverage options that address the specific risks faced by LLCs operating in those sectors.

Legal Compliance and Regulations

In the world of business insurance for LLCs, legal compliance and regulations play a crucial role in ensuring the protection and stability of a company. Insurance providers must adhere to these regulations to offer coverage that meets the necessary standards and requirements.

Legal Requirements for Business Insurance

Business insurance for LLCs is often mandated by state laws and regulations. This typically includes general liability insurance, workers’ compensation insurance, and in some cases, professional liability insurance. These requirements aim to protect both the business and its employees in the event of unforeseen circumstances.

Insurer Compliance with Regulations

Insurance providers ensure compliance with these regulations by thoroughly understanding the specific requirements set forth by each state. They tailor insurance plans to meet these standards and work closely with businesses to ensure they have the necessary coverage. Additionally, insurers regularly update their policies to align with any changes in regulations to guarantee continued compliance.

Implications of Non-Compliance

Non-compliance with insurance regulations can have serious consequences for an LLC. This may result in fines, penalties, or even legal action that can significantly impact the financial stability and reputation of the business. Moreover, operating without the required insurance coverage puts the business at risk of facing lawsuits or claims that it may not be able to handle without insurance protection.

Risk Management Strategies

Effective risk management strategies are crucial for the success of LLCs, as they help in identifying, assessing, and mitigating potential risks that could impact the business operations. Business insurance plays a vital role in risk management by providing financial protection against various risks such as property damage, liability claims, and employee injuries.

Let’s explore how insurance coverage can help LLCs in managing different types of risks and provide real-world examples of its impact.

Mitigating Property Risks

- Property Insurance: Protects business assets such as buildings, equipment, and inventory from damage or loss due to fire, theft, or natural disasters.

- Business Interruption Insurance: Covers lost income and expenses when the business is unable to operate due to a covered peril, helping in business continuity.

Managing Liability Risks

- General Liability Insurance: Protects the business from claims of bodily injury or property damage caused to third parties on the business premises or due to business operations.

- Professional Liability Insurance: Covers claims of negligence or errors in professional services provided by the LLC, offering financial protection against lawsuits.

Addressing Employee Risks

- Workers’ Compensation Insurance: Provides medical benefits and lost wages to employees injured on the job, ensuring compliance with state regulations and protecting the business from lawsuits.

- Employment Practices Liability Insurance: Protects the business against claims of discrimination, harassment, or wrongful termination by employees, safeguarding the company’s reputation and financial stability.

Final Thoughts

Concluding our exploration of the Best Business Insurance Providers for LLCs in 2025, we reflect on the key points discussed, leaving readers with a comprehensive summary of the topic.

Question Bank

What are the emerging trends in the business insurance industry for LLCs?

Emerging trends include increased focus on cybersecurity insurance and usage-based insurance tailored for specific industries.

How do customer reviews influence the choice of insurance provider for an LLC?

Customer reviews provide insights into the quality of customer service, claim processes, and overall satisfaction, helping LLCs make informed decisions.

Why is customized insurance important for LLCs?

Customized insurance plans tailored to the unique needs of LLCs offer comprehensive coverage and protection against industry-specific risks.

What legal requirements and regulations are essential for business insurance for LLCs?

LLCs need to comply with state regulations, including workers’ compensation insurance and general liability insurance, to operate legally.

How can insurance coverage help LLCs in managing unforeseen risks?

Insurance coverage mitigates financial losses from unexpected events like natural disasters, lawsuits, or property damage, ensuring business continuity for LLCs.