Embark on a journey through the intricacies of Small Business Liability Insurance with this comprehensive guide that breaks down the essentials in a clear and engaging manner.

Delve into the nuances and complexities of liability insurance for small businesses with each section providing valuable insights and practical tips.

Introduction to Small Business Liability Insurance

Small business liability insurance is a type of insurance coverage that helps protect small businesses from financial losses resulting from lawsuits or claims filed against them. This insurance policy provides coverage for legal costs, settlements, and judgments that may arise due to bodily injury, property damage, or other liabilities.

Importance of Having Liability Insurance for Small Businesses

Liability insurance is essential for small businesses as it provides financial protection and peace of mind. Without liability insurance, small businesses may face significant financial burdens in the event of a lawsuit or claim. Here are some key reasons why small businesses should have liability insurance:

- Protection from lawsuits: Liability insurance can help cover legal expenses if a small business is sued for negligence, injury, or property damage.

- Business continuity: In the event of a lawsuit, liability insurance can help small businesses stay afloat by covering legal costs and potential settlements.

- Professional credibility: Having liability insurance can enhance the credibility of a small business and provide assurance to clients and partners.

Examples of Situations Where Liability Insurance Can Protect a Small Business

Liability insurance can come to the rescue in various situations where a small business may face legal claims or lawsuits. Here are some examples:

- If a customer slips and falls on the business premises, resulting in a bodily injury claim.

- If a product sold by the business causes harm or injury to a customer, leading to a product liability lawsuit.

- If a small business is accused of copyright infringement or defamation, resulting in a lawsuit for advertising injury.

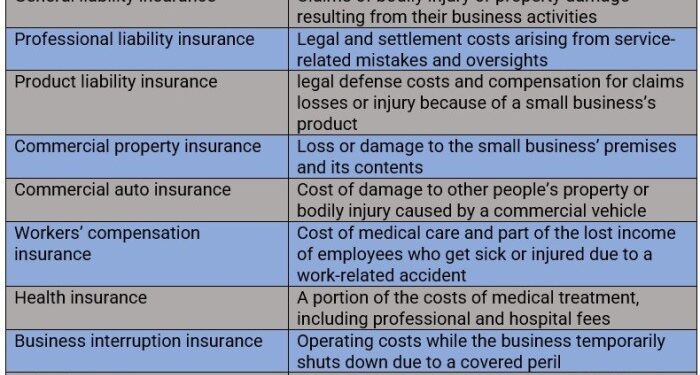

Types of Small Business Liability Insurance

When it comes to protecting your small business from potential risks and lawsuits, having the right type of liability insurance is crucial. There are several types of liability insurance available for small businesses, each offering different coverage and benefits.

General Liability Insurance

General liability insurance is a fundamental type of coverage that protects your business from common risks, such as bodily injury, property damage, and advertising injury. This insurance can help cover legal fees, settlements, and medical expenses in case someone sues your business for these types of incidents.

It is essential for businesses that interact with customers or clients regularly.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, is designed to protect businesses that provide professional services or advice. This type of insurance covers claims of negligence, errors, or omissions that result in financial loss for clients. It is particularly important for consultants, lawyers, accountants, and other professionals.

Product Liability Insurance

Product liability insurance is crucial for businesses that manufacture, distribute, or sell products. This coverage protects your business from liability claims arising from product defects that cause injury or property damage. It can help cover legal costs, settlements, and compensation for affected individuals.

Product liability insurance is essential for businesses in the manufacturing and retail sectors.Each type of liability insurance offers unique benefits and coverage tailored to specific risks faced by small businesses. It is essential to assess your business’s needs carefully and choose the right combination of insurance policies to ensure comprehensive protection against potential liabilities.

Factors to Consider When Buying Small Business Liability Insurance

Before purchasing small business liability insurance, there are several key factors that business owners should consider to ensure they have adequate coverage tailored to their specific needs.

Business Size

The size of your business plays a significant role in determining the type and amount of liability insurance you require. Larger businesses with more employees and higher revenues may need higher coverage limits compared to smaller businesses.

Industry

Different industries have varying levels of risk exposure. For example, a construction company may face higher liability risks compared to a consulting firm. It’s essential to choose coverage that aligns with the specific risks associated with your industry.

Risk Exposure

Evaluate the potential risks your business faces on a daily basis. This includes assessing the likelihood of lawsuits, property damage, or bodily injury claims. Understanding your risk exposure will help you determine the appropriate coverage limits and policy features.

Evaluating Coverage Limits and Deductibles

When selecting small business liability insurance, it’s crucial to carefully evaluate coverage limits and deductibles. Coverage limits refer to the maximum amount your insurer will pay for a claim, while deductibles are the out-of-pocket expenses you must pay before your coverage kicks in.

Consider factors such as your budget, risk tolerance, and the potential financial impact of a claim when deciding on appropriate coverage limits and deductibles.

Choosing an Insurance Provider

When it comes to selecting an insurance provider for small business liability coverage, it is crucial to conduct thorough research and compare different options to ensure you are getting the best coverage for your specific needs.

Research Different Insurance Providers

- Start by researching and compiling a list of insurance providers that offer small business liability insurance.

- Look for companies that specialize in providing coverage for businesses similar to yours, as they may have a better understanding of your specific risks and needs.

Compare Reputation, Financial Stability, and Customer Reviews

- Check the reputation of each insurance provider by looking for reviews and ratings from other small business owners.

- Assess the financial stability of the insurance companies to ensure they can fulfill their obligations in case you need to file a claim.

- Reading customer reviews can give you valuable insights into the quality of service provided by each insurance company.

Tips for Selecting a Reliable Provider

- Choose an insurance provider with a strong reputation for customer service and claims handling.

- Ensure the insurance company has experience working with small businesses and understands the unique risks they face.

- Get quotes from multiple providers to compare coverage options and pricing before making a decision.

- Consider working with an independent insurance agent who can help you navigate the process and find the best coverage for your business.

Cost of Small Business Liability Insurance

Understanding the cost components of small business liability insurance premiums is crucial for budgeting and financial planning. Various factors come into play when determining the cost of insurance, including coverage limits, deductible amounts, and the specific risks associated with your business.

Breakdown of Cost Components

- Base Premium: This is the standard cost of the insurance policy before any additional factors are considered.

- Coverage Limits: The higher the coverage limits, the more expensive the premium. This reflects the maximum amount the insurance will pay out for a claim.

- Deductible Amounts: A higher deductible means lower premiums, but it also means you will pay more out of pocket in the event of a claim.

- Business Risks: The nature of your business, its size, location, and industry all impact the cost of insurance. High-risk businesses will typically have higher premiums.

Strategies to Manage and Reduce Costs

- Shop Around: Compare quotes from multiple insurance providers to find the best rates for your specific needs.

- Bundle Policies: Consider bundling multiple types of insurance (such as liability, property, and workers’ compensation) with the same provider for potential discounts.

- Risk Management: Implement safety protocols and risk mitigation strategies to reduce the likelihood of claims, which can lead to lower premiums over time.

- Review Regularly: As your business grows and changes, your insurance needs may evolve. Regularly review your coverage to ensure you are not overpaying for unnecessary protection.

Conclusion

As we wrap up our discussion on Small Business Liability Insurance, remember that protecting your business is paramount, and the right insurance coverage can make all the difference.

Expert Answers

What does liability insurance for small businesses cover?

Liability insurance typically covers legal costs, settlement fees, and medical expenses in case of third-party claims against the business.

How can small business owners determine the right coverage limits?

Small business owners should assess their business’s specific risks, assets, and industry standards to determine appropriate coverage limits.

Is professional liability insurance necessary for all small businesses?

Professional liability insurance is crucial for businesses that provide services or advice, as it protects against claims of negligence or errors.