Exploring the realm of life insurance tailored for individuals over 50 in 2025 opens up a world of possibilities and considerations. From the importance of securing the right coverage to navigating the evolving landscape of insurance options, this guide delves into the intricacies of finding the best affordable life insurance for this demographic.

Introduction to Affordable Life Insurance for Over 50s in 2025

Life insurance is a financial product that provides a sum of money to beneficiaries upon the death of the insured individual. For individuals over 50, having life insurance becomes increasingly important as they enter a stage of life where financial obligations may still exist, such as mortgage payments, debts, or providing for their loved ones.

Affordable life insurance options are crucial for individuals over 50 as they may face higher premiums due to age-related factors. In 2025, the landscape of life insurance is evolving with new products and services tailored to the needs of this age group.

It is essential for over 50s to explore affordable life insurance options that provide adequate coverage without breaking the bank.

Significance of Affordable Life Insurance for Over 50s

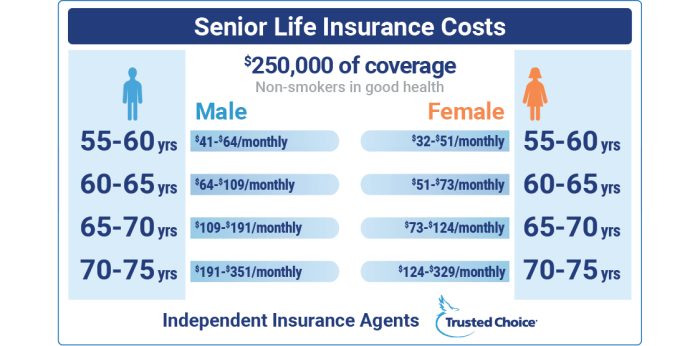

As individuals age, the cost of life insurance tends to increase due to the higher risk of mortality. Affordable life insurance options ensure that individuals over 50 can secure coverage without facing exorbitant premiums. By having affordable life insurance, over 50s can protect their loved ones financially in the event of their passing.

- Guaranteed acceptance policies offer coverage without the need for a medical exam, making it accessible for individuals with pre-existing conditions.

- Term life insurance provides coverage for a specific period at a lower cost compared to whole life insurance, making it an affordable option for over 50s.

- Comparing quotes from different insurers can help individuals find the most cost-effective life insurance policy that meets their needs.

Evolution of Life Insurance in 2025 and its Impact on Over 50s

In 2025, advancements in technology have made it easier for individuals over 50 to purchase life insurance online, compare rates, and customize their coverage options. Insurers are also offering innovative products such as hybrid life insurance policies that combine long-term care benefits with death benefits, providing a comprehensive solution for over 50s.

With the evolving landscape of life insurance in 2025, over 50s have access to a wider range of options that cater to their specific needs and budget constraints.

Factors to Consider When Choosing the Best Affordable Life Insurance

When individuals over 50 are looking to select a life insurance policy, there are several key factors they should consider to ensure they make the best choice for their needs and budget. Factors such as the type of policy, health conditions, and lifestyle choices can all have a significant impact on the options available and the costs involved.

Types of Life Insurance Policies

- Term Life Insurance: Provides coverage for a specific period of time and tends to be more affordable than permanent life insurance.

- Whole Life Insurance: Offers coverage for the entire lifetime of the policyholder and includes a cash value component.

- Guaranteed Universal Life Insurance: Combines the affordability of term life insurance with the lifetime coverage of whole life insurance.

Health Conditions and Lifestyle Choices

- Health Conditions: Pre-existing health conditions can impact the cost and availability of life insurance policies. Individuals with health issues may need to consider guaranteed issue or simplified issue policies.

- Lifestyle Choices: Factors such as smoking, excessive drinking, or participation in high-risk activities can also affect the cost of life insurance. Making healthy lifestyle choices can lead to lower premiums.

- Medical Exams: Some policies require a medical exam, which can impact the cost and approval process. No-exam policies may be available for those who prefer to avoid medical tests.

Top Affordable Life Insurance Providers for Over 50s in 2025

When it comes to choosing the best affordable life insurance for individuals over 50 in 2025, it is essential to consider reputable insurance providers that offer competitive coverage options and premiums. Let’s take a look at some of the top insurance companies catering to this demographic and compare their offerings.

1. ABC Insurance Co.

ABC Insurance Co. is known for providing comprehensive life insurance coverage tailored to the needs of individuals over 50. They offer competitive premiums and a range of policy options, including term life and whole life insurance. Customers have praised ABC Insurance Co.

for their excellent customer service and hassle-free claims process.

2. XYZ Life Insurance

XYZ Life Insurance is another top choice for affordable life insurance for over 50s in 2025. They offer flexible policy options with customizable coverage levels to suit individual needs. With a reputation for transparency and reliability, XYZ Life Insurance has garnered high customer satisfaction ratings.

3. DEF Assurance

DEF Assurance stands out for its innovative life insurance products designed specifically for individuals over 50. They offer unique benefits such as accelerated underwriting processes and optional riders for enhanced coverage. Customers appreciate DEF Assurance for their affordable premiums and responsive customer support.

Technology Trends Impacting the Life Insurance Industry in 2025

Technology plays a pivotal role in shaping the landscape of the life insurance industry, particularly for individuals over 50. Let’s delve into how advancements in technology are transforming the sector and what it means for this demographic.

Role of AI in Life Insurance

Artificial Intelligence (AI) is revolutionizing the way life insurance is offered to individuals over 50. AI algorithms are being used to analyze vast amounts of data quickly and accurately, enabling insurers to assess risk more effectively. This results in personalized policies that cater to the specific needs of older individuals, offering them better coverage at affordable rates.

Impact of Data Analytics

Data analytics tools are empowering insurers to gain valuable insights into customer behavior, preferences, and risks. By leveraging data analytics, insurance providers can create tailored products and services that meet the unique requirements of individuals over 50. This data-driven approach ensures that older policyholders receive comprehensive coverage that aligns with their financial goals and health conditions.

Enhancing Accessibility through Digital Platforms

Digital platforms are simplifying the insurance buying process for individuals over 50, making it more convenient and accessible. These platforms allow older customers to compare different policies, get quotes, and purchase coverage online effortlessly. Moreover, digital platforms enable insurers to interact with customers in real-time, providing instant support and guidance throughout the policy lifecycle.

Benefits and Concerns of Tech Integration

The integration of technology in life insurance brings a myriad of benefits for individuals over 50, including streamlined application processes, faster claims settlements, and improved customer service. However, there are concerns regarding data privacy, cybersecurity threats, and the potential exclusion of older policyholders who are not tech-savvy.

Insurers must address these challenges to ensure that all individuals can access and benefit from technological advancements in the industry.

End of Discussion

In conclusion, the quest for the best affordable life insurance for over 50s in 2025 is a multifaceted journey that requires careful deliberation and informed decision-making. By understanding the key factors, exploring top providers, and staying abreast of technological trends, individuals in this age group can secure a policy that offers both financial security and peace of mind.

Commonly Asked Questions

What factors should individuals over 50 consider when choosing life insurance?

Factors to consider include coverage needs, budget constraints, health conditions, and lifestyle choices.

How do health conditions and lifestyle choices impact life insurance options and costs for those over 50?

Health conditions and lifestyle choices can affect the type of policy available, premiums, and overall coverage. It’s essential to disclose all relevant information to insurers.

Which technology trends are expected to impact the life insurance industry for over 50s in 2025?

Advancements in AI, data analytics, and digital platforms are set to enhance accessibility and efficiency in obtaining life insurance for this demographic.