Delving into the realm of Full Coverage Insurance Quotes: Do They Really Cover Everything?, this introduction invites readers with a blend of expertise and originality, promising an insightful exploration of the topic.

The subsequent paragraph will provide detailed information on the subject.

Overview of Full Coverage Insurance

Full coverage insurance is a type of auto insurance policy that typically includes a combination of coverages to provide a higher level of protection for the policyholder. While the specific components of full coverage insurance can vary depending on the insurance provider and policy, it often includes:

– Liability coverage

– Collision coverage

– Comprehensive coverage

– Uninsured/underinsured motorist coverage

Despite the name, full coverage insurance does not cover absolutely everything, and there are common misconceptions about what it includes. It’s important for policyholders to understand the limitations of their coverage and any additional options they may need to consider.

Common Misconceptions about Full Coverage Insurance

Some misconceptions about full coverage insurance include:

- Full coverage insurance covers all types of damage to your vehicle.

- Full coverage insurance is the most expensive option available.

- Full coverage insurance always includes rental car coverage.

Examples of Situations where Full Coverage Insurance may be Beneficial

Full coverage insurance can be beneficial in various situations, such as:

- When you have a new or high-value vehicle that you want to protect against damage.

- When you live in an area prone to natural disasters, theft, or vandalism.

- When you want additional peace of mind knowing that you have more comprehensive coverage.

Understanding Full Coverage Insurance Quotes

When obtaining full coverage insurance quotes, several factors are taken into consideration by insurance providers to determine the cost and coverage options that best suit the policyholder’s needs. Understanding these factors and the process of getting quotes is essential for making an informed decision.

Factors Considered for Full Coverage Insurance Quotes

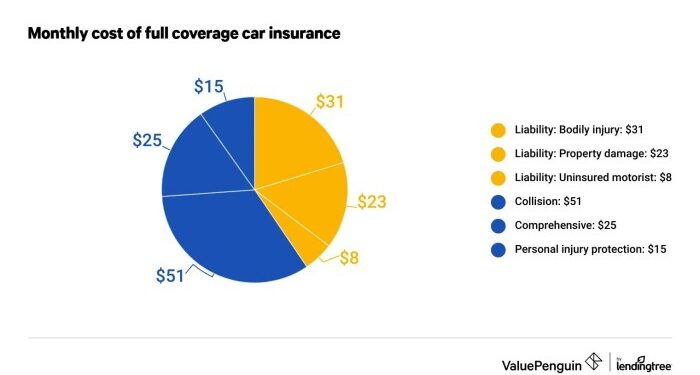

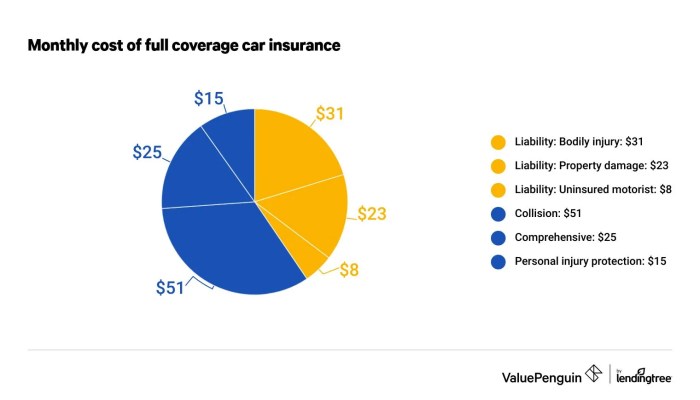

- The type of coverage required, such as liability, collision, comprehensive, and personal injury protection.

- The policyholder’s driving record, age, gender, and location.

- The make, model, and year of the vehicle to be insured.

- The deductible amount chosen by the policyholder.

Process of Getting Full Coverage Insurance Quotes

- Contact insurance providers either online, by phone, or in person to request quotes.

- Provide accurate information about yourself, your vehicle, and the coverage options you are interested in.

- Receive and compare quotes from different insurance companies to find the best coverage at a competitive price.

Tips for Comparing Full Coverage Insurance Quotes

- Ensure you are comparing similar coverage options and deductible amounts when evaluating quotes.

- Look for discounts or special offers that may be available from different insurance providers.

- Consider the reputation and customer service of the insurance company when making your decision.

- Review the policy details carefully to understand any exclusions or limitations that may apply.

What Does Full Coverage Insurance Really Cover?

When it comes to full coverage insurance, it is important to understand what is included and what limitations exist. While full coverage insurance may sound comprehensive, there are still certain scenarios where it may not cover everything you expect.

Types of Coverage Included in Full Coverage Insurance

Full coverage insurance typically includes the following types of coverage:

- Liability coverage for bodily injury and property damage

- Collision coverage for damage to your own vehicle in an accident

- Comprehensive coverage for damage from non-collision incidents like theft, vandalism, or natural disasters

- Uninsured/underinsured motorist coverage

Limitations of Full Coverage Insurance Policies

Despite its name, full coverage insurance does not cover everything. Some limitations to be aware of include:

- Coverage limits that may not fully cover the cost of repairs or medical expenses

- Deductibles that you are responsible for paying before insurance kicks in

- Exclusions for certain types of incidents or circumstances

Scenarios Where Full Coverage Insurance May Not Cover Everything

There are situations where even with full coverage insurance, you may find yourself not fully protected. For example:

- If you are at fault in an accident and your liability coverage is insufficient to cover the other party’s damages

- If your vehicle is damaged in a specific way that is not covered by your policy

- If you are involved in a hit-and-run and cannot identify the other driver

Additional Coverage Options to Consider

When it comes to insurance coverage, it’s essential to understand that full coverage insurance may not cover every possible scenario. That’s why considering additional coverage options can provide extra protection and peace of mind in various situations. It’s crucial to explore supplemental insurance options that can complement full coverage insurance and fill in any gaps that may exist.

Understanding the Fine Print

Reading the fine print of insurance policies is crucial to fully comprehend what is covered and what is not. Insurance policies often contain specific details and exclusions that can impact the extent of coverage. It’s essential to pay attention to details like deductibles, limits, and exclusions to ensure you have a clear understanding of your coverage.

- Take the time to review your policy documents carefully to understand the terms and conditions.

- Consult with your insurance provider or agent to clarify any doubts or questions you may have.

- Be aware of any limitations or restrictions that may apply to your coverage.

Customizing Your Insurance Coverage

Customizing your insurance coverage to suit your individual needs is a smart way to ensure you have the right level of protection. Depending on your circumstances and lifestyle, you may want to consider adding specific types of coverage to your policy to enhance your overall protection.

- Consider adding umbrella insurance to provide additional liability coverage beyond your standard policy limits.

- Explore options for comprehensive coverage to protect against non-collision incidents like theft, vandalism, or natural disasters.

- Evaluate the need for medical payments coverage to help pay for medical expenses resulting from an accident, regardless of fault.

Final Conclusion

Concluding our discussion, the outro will encapsulate key points and reflections on the topic in a compelling manner.

FAQ Compilation

What does full coverage insurance typically include?

Full coverage insurance usually includes comprehensive and collision coverage, along with liability coverage.

What factors are considered when obtaining full coverage insurance quotes?

Factors such as age, driving record, location, and type of vehicle are commonly considered when obtaining full coverage insurance quotes.

What types of coverage are usually included in full coverage insurance?

Full coverage insurance typically includes comprehensive, collision, and liability coverage.

What are some limitations of full coverage insurance policies?

Limitations may include coverage caps, exclusions for specific circumstances, and high deductibles.

How can insurance coverage be customized to suit individual needs?

Insurance coverage can be customized by adding supplemental insurance options and adjusting coverage limits based on personal circumstances.