Delving into Restaurant Insurance Quotes: What You Need to Know Before Opening, this introduction immerses readers in a unique and compelling narrative, with engaging language that is both informative and thought-provoking.

The following paragraphs will provide a detailed exploration of the essential aspects related to restaurant insurance quotes before embarking on a new venture in the food industry.

Researching Restaurant Insurance Quotes

Before opening a restaurant, it is crucial to research insurance quotes to protect your business from unforeseen risks and liabilities.

Types of Insurance Coverage Needed for a Restaurant

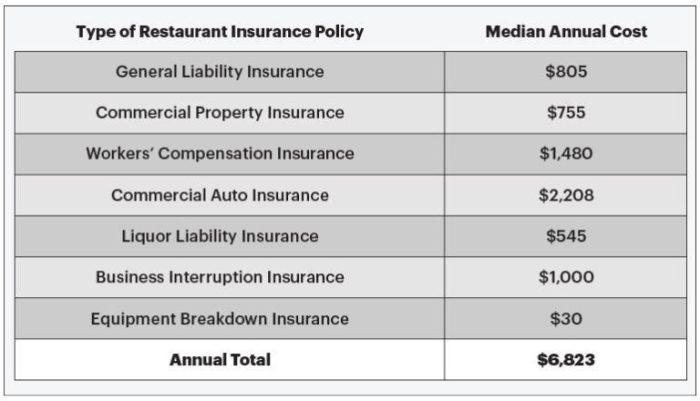

When it comes to restaurant insurance, there are several types of coverage that are essential to consider:

- General Liability Insurance: Protects against third-party claims for bodily injury, property damage, and personal injury.

- Property Insurance: Covers damage or loss of property due to events like fire, theft, or natural disasters.

- Workers’ Compensation Insurance: Provides coverage for employees who are injured on the job.

- Liquor Liability Insurance: Necessary if your restaurant serves alcohol to protect against alcohol-related incidents.

Factors Impacting the Cost of Restaurant Insurance

Several factors can influence the cost of restaurant insurance:

- Location: The area where your restaurant is located can affect the risk level and insurance rates.

- Size of the Restaurant: The square footage and capacity of your restaurant can impact the insurance cost.

- Type of Cuisine: The type of food you serve and the associated risks can influence insurance premiums.

- Claims History: A history of insurance claims can lead to higher premiums.

Understanding Coverage Options

When it comes to restaurant insurance, understanding the coverage options available is crucial for protecting your business against unforeseen events. Here, we will delve into the types of coverage typically included in restaurant insurance policies and the importance of having adequate coverage limits.

Types of Coverage

- Liability Insurance: This type of coverage protects your restaurant from claims related to bodily injury, property damage, or personal injury. It is essential for covering legal expenses and potential settlements.

- Property Insurance: Property insurance safeguards your restaurant’s physical assets, such as the building, equipment, and inventory, against damage or loss due to events like fire, theft, or vandalism.

- Business Interruption Insurance: Business interruption insurance provides coverage for lost income and ongoing expenses if your restaurant is forced to close temporarily due to a covered event, such as a fire or natural disaster.

Significance of Adequate Coverage Limits

Having adequate coverage limits for different aspects of your restaurant is crucial to ensure that you can recover financially after a loss. For liability insurance, it is important to consider the potential costs of legal fees and settlements in case of a lawsuit.

Property insurance should cover the full replacement value of your restaurant’s assets to avoid out-of-pocket expenses in the event of damage or loss. Business interruption insurance should have sufficient limits to cover ongoing expenses and lost income during the closure period to prevent financial strain on your business.

Obtaining Quotes from Insurance Providers

When seeking insurance coverage for a restaurant, it is crucial to obtain quotes from different providers to compare options and find the best fit for your business. Here’s a guide on how to navigate the process effectively.

Comparing Quotes Effectively

- Start by researching reputable insurance providers in your area that specialize in restaurant coverage.

- Reach out to multiple providers to request quotes based on the specific needs and size of your restaurant.

- Ask for detailed breakdowns of coverage options, including liability, property, workers’ compensation, and any additional riders.

- Consider the reputation and financial stability of each insurance provider to ensure they can meet your needs in the long term.

- Compare premiums, deductibles, coverage limits, and any exclusions or limitations in each quote to make an informed decision.

Reviewing Policy Exclusions and Limitations

- Pay close attention to any exclusions or limitations Artikeld in the insurance quotes, as they can significantly impact your coverage.

- Look for common exclusions such as acts of terrorism, pollution, or specific types of damage that may not be covered under a standard policy.

- Consider adding endorsements or riders to your policy to cover any gaps in coverage that are not addressed in the initial quote.

- Consult with an insurance agent or broker to clarify any unclear terms or conditions in the quotes before making a final decision.

Factors Affecting Insurance Costs

When it comes to insuring a restaurant, various factors can influence the insurance costs that a restaurant owner will need to budget for. Understanding these factors is crucial for managing expenses effectively and ensuring adequate coverage.

Location Impact on Insurance Costs

The location of a restaurant plays a significant role in determining insurance costs. Restaurants located in high-crime areas or regions prone to natural disasters may face higher premiums due to increased risks of theft, vandalism, or property damage. On the other hand, restaurants in safe neighborhoods with lower crime rates may benefit from lower insurance costs.

Size and Type of Restaurant Operations

The size and type of restaurant operations also impact insurance premiums. Larger restaurants with more extensive facilities and higher foot traffic may face higher liability risks, leading to increased insurance costs. Additionally, the type of cuisine served and the presence of alcohol service can affect premiums, as certain cuisines or alcohol service may pose higher risks.

Ways to Lower Insurance Costs for a New Restaurant

There are several strategies that new restaurant owners can employ to potentially lower insurance costs. Implementing safety measures such as installing security cameras, fire alarms, and sprinkler systems can demonstrate a commitment to risk management, potentially reducing premiums. Moreover, investing in staff training programs to promote workplace safety and proper food handling can help lower the likelihood of accidents or liability claims, leading to cost savings in the long run.

Compliance and Legal Requirements

When it comes to restaurant insurance coverage, it is crucial to understand the legal requirements in different jurisdictions. Compliance with regulations directly impacts the insurance needs of a restaurant, as failure to meet these requirements can result in fines, penalties, or even closure of the business.

Common Compliance Issues

- Liquor License: Restaurants that serve alcohol must have the proper liquor license to comply with regulations. Failure to have this license can lead to increased liability risks and affect insurance coverage.

- Health and Safety Regulations: Restaurants must adhere to strict health and safety regulations to ensure the well-being of customers and employees. Non-compliance can result in fines and impact insurance coverage.

- Employment Laws: Restaurants need to comply with employment laws regarding wages, working hours, and employee rights. Violations can lead to legal issues and affect insurance costs.

- Food Handling Regulations: Restaurants must follow food handling and storage regulations to prevent foodborne illnesses. Failure to comply can result in health violations and impact insurance coverage.

- Building Codes: Compliance with building and fire codes is essential to ensure the safety of the establishment. Non-compliance can lead to increased risks and affect insurance coverage.

Final Review

In conclusion, understanding the nuances of restaurant insurance quotes is crucial for a successful business launch. By being aware of the coverage options, obtaining quotes wisely, and ensuring compliance with legal requirements, restaurant owners can protect their investment and focus on providing exceptional dining experiences.

FAQ Compilation

What are the different types of insurance coverage needed for a restaurant?

Restaurant insurance typically includes general liability insurance, property insurance, workers’ compensation, and business interruption insurance to cover various risks associated with running a restaurant.

How can one potentially lower insurance costs for a new restaurant?

To reduce insurance costs, restaurant owners can implement safety measures, choose higher deductibles, bundle insurance policies, and maintain a good claims history.

What are the legal requirements for restaurant insurance coverage?

Legal requirements for restaurant insurance coverage vary by jurisdiction but often include general liability insurance and workers’ compensation to protect employees and customers.

Why is it important to review policy exclusions and limitations in insurance quotes?

Reviewing policy exclusions and limitations helps restaurant owners understand what risks may not be covered by their insurance policy, allowing them to make informed decisions about their coverage needs.