Exploring the realm of insurance comparison tools for businesses, this introduction sets the stage for an enlightening journey filled with valuable insights and practical tips.

In the following paragraphs, we will delve into the intricacies of selecting the best tools and factors to consider when comparing insurance quotes for your business.

Researching Insurance Options

Researching insurance options for your business is crucial to ensure you find the right coverage that meets your specific needs. Different insurance providers offer varying coverage options, including different limits, deductibles, and additional features. By researching and comparing insurance quotes from multiple providers, you can find the best policy that offers adequate coverage at a competitive price.

Importance of Researching Insurance Options

- Researching insurance options allows you to understand the different types of coverage available for your business.

- It helps you identify any gaps in your current coverage and ensure you are adequately protected.

- By comparing quotes, you can find cost-effective policies that offer the best value for your business.

Varying Coverage Options Offered by Providers

- Insurance providers offer a wide range of coverage options, including general liability, property insurance, workers’ compensation, and more.

- Each provider may have different policy limits, exclusions, and terms, so it’s essential to compare these details carefully.

- Some providers may offer additional coverage options or endorsements that can enhance your policy to better suit your business needs.

Benefits of Comparing Insurance Quotes

- Comparing insurance quotes allows you to find the most competitive rates available in the market.

- You can tailor your policy to your specific needs by selecting the coverage options that matter most to your business.

- By comparing quotes, you can potentially save money on insurance premiums while ensuring you have adequate coverage in place.

Best Tools for Comparing Insurance Quotes

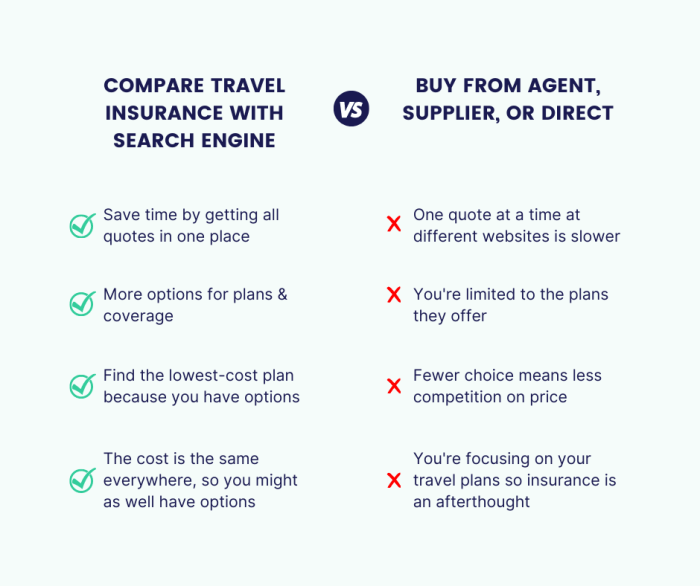

When it comes to finding the best insurance coverage for your business, using online tools to compare quotes can save you time and money. These tools streamline the process by providing you with multiple quotes from different insurers, allowing you to easily compare prices and coverage options.

Let’s take a look at some popular online tools that can help you find the right insurance policy for your business.

Insureon

Insureon is a popular online tool that allows you to compare insurance quotes from top providers in minutes. Simply enter some basic information about your business, and Insureon will provide you with multiple quotes tailored to your specific needs. The platform is user-friendly and offers a wide range of insurance products for small businesses.

Policygenius

Policygenius is another great tool for comparing insurance quotes. This platform allows you to compare quotes for various types of insurance, including general liability, professional liability, and workers’ compensation. Policygenius is known for its easy-to-use interface and personalized recommendations based on your business needs.

NetQuote

NetQuote is a well-established online tool that helps you compare insurance quotes from multiple providers. The platform allows you to input your information just once and receive quotes from different insurers. NetQuote is known for its accuracy and comprehensive coverage options, making it a reliable choice for business owners.

How These Tools Simplify the Process

- Save Time: By using online tools, you can quickly receive multiple insurance quotes without having to contact each provider individually.

- Compare Prices: These tools allow you to compare prices and coverage options side by side, making it easier to find the best policy for your budget.

- Personalized Recommendations: Many tools offer personalized recommendations based on your business type and needs, helping you make an informed decision.

Factors to Consider When Comparing Quotes

When comparing insurance quotes for your business, there are several key factors that you should take into consideration to make an informed decision. Understanding how coverage limits, deductibles, premiums, reputation, and financial stability of insurance providers play a crucial role in selecting the right insurance policy for your business.

Coverage Limits

- Insurance coverage limits determine the maximum amount an insurance company will pay for a covered claim. It is essential to assess whether the coverage limits offered align with the potential risks your business may face.

- Consider your business’s unique needs and ensure that the coverage limits are adequate to protect your assets and liabilities.

- Review the policy to understand any exclusions or limitations that may impact your coverage in specific scenarios.

Deductibles

- Deductibles are the out-of-pocket expenses you are required to pay before your insurance coverage kicks in. Evaluate how deductibles can impact your overall cost and financial risk.

- Higher deductibles typically result in lower premiums, but it is crucial to assess whether your business can afford the deductible amount in the event of a claim.

- Consider your risk tolerance and financial capacity when choosing a deductible that strikes a balance between cost savings and financial protection.

Premiums

- Premiums are the amount you pay for insurance coverage. Compare premiums from different insurance providers to ensure you are getting competitive rates for the coverage offered.

- Consider the overall value of the coverage in relation to the premium amount to determine if it aligns with your budget and risk management strategy.

- Look for any potential discounts or incentives that may help lower your premiums without compromising on the quality of coverage.

Reputation and Financial Stability

- Evaluate the reputation of insurance providers by researching customer reviews, ratings, and feedback from other businesses or industry experts.

- Check the financial stability of insurance companies by reviewing their financial ratings and stability reports from agencies like A.M. Best, Moody’s, or Standard & Poor’s.

- Choose insurance providers with a strong reputation and financial standing to ensure they can fulfill their obligations in the event of a claim and provide reliable service and support.

Utilizing Online Calculators

Online calculators can be valuable tools for estimating insurance costs for businesses. These tools are designed to take into account various factors specific to your business and insurance needs, providing you with a more accurate estimate of potential costs.

Types of Online Calculators

- General Liability Insurance Calculator: These calculators take into consideration factors such as business size, industry type, location, and coverage limits to estimate the cost of general liability insurance.

- Workers’ Compensation Insurance Calculator: Tailored specifically for estimating the cost of workers’ compensation insurance based on factors like number of employees, payroll, and industry risks.

- Commercial Property Insurance Calculator: Factors in property value, location, coverage limits, and property type to generate estimates for commercial property insurance costs.

Accuracy of Calculators

Online calculators utilize algorithms that consider a wide range of variables to provide accurate estimates. These variables may include industry risks, location-specific factors, coverage limits, and business size. By inputting relevant information into these calculators, businesses can receive estimates that closely reflect their unique insurance needs.

Outcome Summary

In conclusion, navigating the world of insurance comparison tools can lead to informed decisions and significant cost savings for your business. By utilizing the right tools and considering key factors, you can secure the best insurance coverage tailored to your specific needs.

Key Questions Answered

What are the key benefits of researching insurance options for businesses?

Researching insurance options allows businesses to understand the range of coverage available, compare quotes from different providers, and make informed decisions based on their specific needs and budget.

How do online calculators assist in estimating insurance costs for businesses?

Online calculators utilize key variables such as coverage limits, deductibles, and premiums to provide accurate estimates tailored to different types of insurance, aiding businesses in budgeting and decision-making processes.

Why is it essential to evaluate the reputation and financial stability of insurance providers when comparing quotes?

Evaluating the reputation and financial stability of insurance providers ensures that businesses choose reliable partners who can fulfill their coverage needs and provide support in times of claims or emergencies.